Brewery Compliance 101: Tackling the Top 10 TTB Audit Issues

- Brewery Compliance Team

- Jul 23, 2025

- 9 min read

Updated: Jul 24, 2025

Running a brewery is tough enough without wrestling through a maze of TTB rules, and it’s all too easy to trip over something you didn’t even know existed. When those federal investigators or auditors come knocking, they’ll comb through everything from your tax filings and permit validity to record-keeping accuracy and labeling details—they might even measure the size of the Government Warning/Health Warning Statement on your labels. Regulations like 27 CFR Part 16 state that the warning text on your 16oz pint of beer must be “not smaller than 2 mm” in size—bet you didn’t know that! Most TTB audit issues fall into distinct categories, including tax-related problems, operational reporting errors, record-keeping oversights, permit compliance mistakes, and labeling or formula approval violations. Understanding these categories helps you prioritize compliance actions and steer clear of the most common (and costly) pitfalls.

Sure, you’ve got your Forms 5000.24 (Excise Tax Return) and 5130.9 (Brewer's Report of Operations) on auto‑file, but are they actually accurate? What about breakage records? Under 27 CFR 25.292, you’re required to log every bottle/can or keg that gets broken (by the next business day) with the date, volume, and even a brief note on how it happened (forklift mishap, anyone?). Skip that, and the TTB can treat those “lost” barrels as unreported removals. By getting ahead of both the headline regulations and these little‑known quirks, you’ll dodge nasty surprises, keep penalties at bay.

Before you dive into the full list, consider this, every one of these issues boils down to two things, tracking your volumes precisely and matching your operations to the right paperwork. Get those fundamentals nailed, and you’ll neutralize 90% of the common audit triggers. Ready? Let’s count down the top ten.

10. Tax‑Deferred or Tax‑Free Removals

Under federal regulations, several specific scenarios let you move beer without owing federal excise tax: beer held in your bonded brewery remains tax‑deferred until removal; you can transfer beer untaxed between breweries under common ownership so long as you keep the required records; beer that’s contaminated, spoiled, or otherwise unfit for beverage use may be removed tax‑free if you document the defect, quantity, and disposition; you may destroy damaged or tax‑determined beer on your premises (following Subpart N recordkeeping) and claim relief of tax; legitimately exported beer can qualify for a drawback refund when you file Form 5130.6 with proof of export; brewer’s yeast, trub, and other non‑beverage byproducts may be removed tax‑free under §§ 25.251–25.252; and beer diverted into further manufacturing (such as vinegar or hand sanitizer) can qualify for tax relief or refund if you file Form 5620.8 and demonstrate the non‑beverage use under Subpart T. Unlike wine, where small wineries may withdraw limited quantities un-taxed for “Removed for family use”, commercial breweries have no “family withdrawal” exemption, and state homebrew statutes (which allow individuals to brew tax‑free up to 100,000 gal/year) do not apply to licensed breweries.

9. Payment‑Method Violations

When your brewery’s annual excise liability exceeds the small‑brewer threshold or you’re part of a controlled group, the TTB mandates that all excise taxes be paid by electronic funds transfer (EFT). If an EFT deposit isn’t received on or before the due date, the TTB imposes a failure‑to‑deposit penalty of 2 percent to 15 percent of the underpaid amount, depending on how many days late the transfer is. On top of that, any unpaid tax incurs a failure‑to‑pay penalty of 0.5 percent per month (or part of a month), capped at 25 percent of the unpaid balance, plus daily interest at the federal short‑term rate plus 3 percent, compounded until the debt is satisfied… Missing these requirements, even by accident after a corporate restructure or with a new tax preparer, can quickly balloon your liability and disrupt cash flow, so it’s critical to confirm your EFT obligations each year and verify your payment setup well before each filing deadline.

8. Formulas and COLAs Never Obtained

Not every beer needs an approved TTB Formula, only those that use non‑standard ingredients, processes or otherwise deviate from a previously approved recipes require a TTB Formula Approval (Form 5110.2). TTB offers a list of pre-approved ingredients which brewers can use without triggering the requirement for a Formula. However, using extracts, essential oils, and syrups always require a formula to be approved. Example – Cherries are a preapproved ingredient if they are in the form off whole cherries, juice, puree, or concentrate. If you use a cherry extract, essential oil, or syrup your beer must obtain a Formula. Even if you only sell the beer in your tasting room, a Formula could be required.

You only need a Certificate of Label Approval (COLA) (approval of your label) when shipping beer across state lines. However, many states require a copy of a TTB‑approved COLA as part of their own product registration process. To stay ahead of both federal and state requirements, maintain a centralized dashboard, whether that’s a spreadsheet or a dedicated management tool, or compliance agency, that tracks each recipe’s approval status and every label’s COLA number. Include submission dates and set automated reminders for follow‑ups, so you never brew or ship an unapproved beer.

7. Failure to Report Changes in Ownership or Control

TTB regulations require you to notify the agency within 30 days of any change in proprietorship, corporate structure, or key personnel, yet many breweries overlook how broad this obligation is. It isn’t limited to full buy‑outs or mergers, even minor stock transfers that shift controlling interest, the addition or departure of a silent partner, or the promotion or resignation of a corporate officer qualifies as a “change in control.” If you don’t submit the proper notice (for beer, via Form 5130.10), your Basic Permit can be automatically suspended or revoked without warning, bringing all bonded operations brewing, bottling, removals, even sample transfers to a halt.

6. Missed or Inaccurate Operational Reports

The TTB Brewer’s Reports of Operations report is a fundamental TTB operational reporting requirement, and every permitted brewery must file it on the correct schedule, monthly if your annual removals exceed the small‑brewer threshold, quarterly if they fall below it, or annually under certain limited‑permit provisions. Despite this clear schedule, many breweries mistakenly file on the wrong frequency, submitting a quarterly report when monthly is required, or lumping several months into one annual return. These timing errors alone can trigger “failure to file” violation and an email from TTB requiring you to refile everything! It could be years’ worth of quarterly reports which must now be turned into monthly reports.

Inaccurate data compounds the problem, even if you are using production and compliance software, the data is only as good as the information you and your team enters into it. Common slip‑ups include transposing removal volumes (e.g., reporting 140 gallons when 150 gallons actually left the tanks), failing to keep accurate bonded inventory records and failing to take into account bonded transfers. Such mistakes can lead to audit adjustments, “failure to file” penalties of up to $50 per day per return, interest on any underpaid excise tax, and the burden of filing amended reports.

5. Operating Without a Valid Permit (More common than you think)

Operating without the right TTB permit is more common than you think and it’s not just about brewing beer without a brewer’s permit. If a permitted brewery starts making hard cider, you’ve suddenly crossed into “wine” territory under federal rules (even if your state treats cider like beer), so you need a winery permit to stay legal. Likewise, fermenting kombucha with fruit or juice base makes it a “wine” product in the eyes of the TTB, meaning a standard Brewer’s Notice (Brewery Permit) won’t cut it; you must hold the appropriate wine‐producer permit. Without that wine‐producer permit, you’re effectively running your brewery outside the scope of your license. From manufacturing and bottling to warehousing and even moving samples between locations, every activity must match the permit type on file. Skip that step, and you risk cease‑and‑desist orders, hefty fines, potential permit revocations and even criminal violations. So, keep your permits aligned with every product you make.

4. Failure to Maintain Adequate Bond Coverage

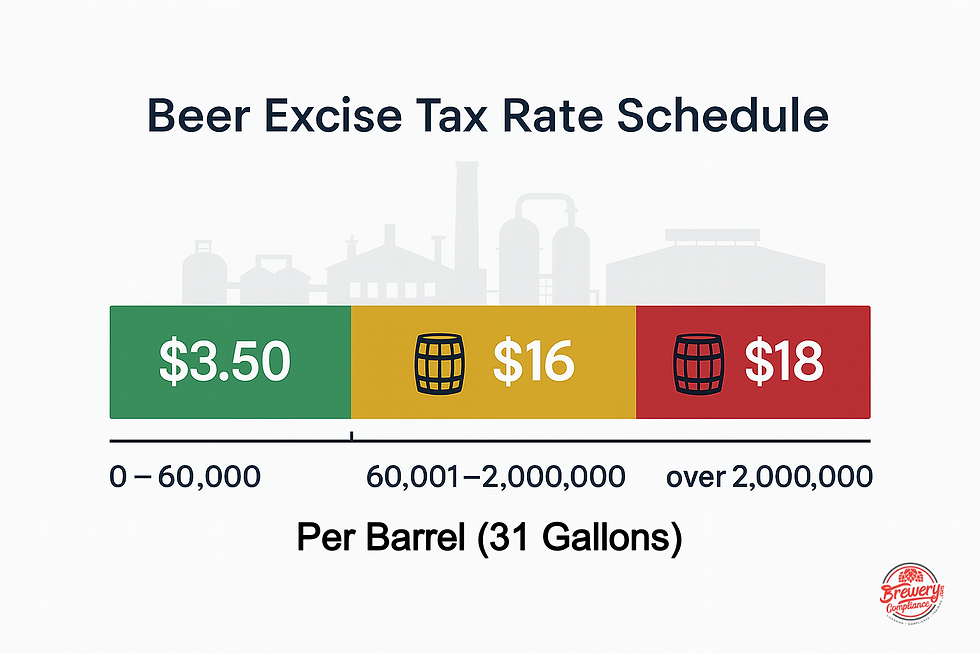

Under the PATH Act exemption, any brewer whose federal excise tax liability was under $50,000 in the prior year and is expected to stay below $50,000 this year does not need a surety bond as of January 1, 2017. However, once you exceed that threshold, you must secure a bond equal to a percentage of your maximum annual tax liability under 27 CFR Part 25, Subpart H. TTB computes that liability using the current excise rates for a small domestic brewer: $3.50 per barrel on the first 60,000 barrels and $16 per barrel on the portion above 60,000 (up to 2 million barrels).

Your bond’s penal sum must equal 29 percent of this calculated liability if you file returns quarterly, or 10 percent if you file semi‑monthly, with a statutory minimum of $1,000 ($500 for pilot plants) and a cap at $500,000. For instance, a brewery projecting 80,000 barrels would face a maximum tax liability of (60,000 × $3.50) + (20,000 × $16) = $530,000; a quarterly filer must therefore post a bond of $153,700 (29 percent of $530,000), while a semi‑monthly filer needs $53,000 (10 percent). Removing beer beyond your bond’s coverage or allowing your bond (or exemption) to lapse exposes you to civil penalties, bond forfeiture, and possible suspension or revocation of your Basic Permit. Monitoring your projected and actual removals against your bond and filing a strengthened bond ahead of any coverage gaps, is critical to keeping your brewery in compliance.

3. Inadequate or Inaccurate Record-keeping

TTB’s number‑one audit finding is sloppy logs. Under 27 CFR 25.292, every removal, return, breakage, and transfer must be entered into your Daily Records of Operations by the end of the next business day, including the date, volume, and customer or destination. A brewery that fails to log a 500‑gallon keg transfer on July 10 until July 12 has committed a clear violation. Likewise, 27 CFR 25.211 demands precise Returned Beer Records: if a customer returns five kegs, you must document the exact quantity, container IDs, and proof of return. Relying on “tapping off” a keg to eyeball the volume is considered an unsound estimation method and will almost certainly be adjusted.

Violations carry consequences. Inaccurate or missing entries can trigger civil penalties (up to $10,000 per incident) and interest on any underpaid excise tax. Repeated or egregious recordkeeping failures may even lead TTB to suspend or revoke your Basic Permit, effectively shutting down production, bottling, and shipments. Keeping precise, up‑to‑date logs isn’t just best practice, it’s essential to avoid penalties, interest charges, and operational shutdowns.

2. Misapplication of Craft Beverage Modernization Act (CBMA) Rates

Under the CBMA, qualifying small domestic brewers (those producing 2 million barrels or less per year) enjoy a stepped excise tax schedule: $3.50 per barrel on the first 60,000 barrels removed and $16 per barrel on the next 1,940,000 barrels. Once annual removals exceed 2 million barrels, the full $18 per barrel rate applies to all additional volume.

Any beer you remove that you did not produce yourself including contract‑brewed batches from another TTB‑licensed facility, cannot qualify for the reduced CBMA rates. Likewise, U.S. importers without a reduced‐rate assignment from a foreign brewer, brewers who’ve used up their 60,000‑barrel $3.50 entitlement for the year, and importers who have already taken advantage of assigned reduced rates must all pay the full $18 per barrel excise tax on those removals. Make sure to apply the correct rate in your Brewer’s Report of Operations, ensuring no barrels slip through at the lower $3.50 or $16 rates when the $18 per barrel rate sound apply.

1. Late or Missing Excise Tax Filings and Payments

Falling behind on your beer excise tax obligations can trigger three distinct penalties. First, Failure‑to‑File (FTF) applies if you miss the deadline to submit Form 5000.24 (Excise Tax) or Form 5130.9 (Brewers Report of Operations) itself, even a zero‑activity return filed late can rack up daily fines. Second, Failure‑to‑Deposit (FTD) kicks in when you file on time but miss the EFT or payment deadline, with a percentage‑based penalty that grows the longer the delay. Finally, Failure‑to‑Pay (FTP) applies if you file your return but don’t pay the tax by its due date; each month (or part of a month) adds 0.5 percent to your unpaid balance, plus daily interest on any remaining tax.

For example, if ZZZ Brewing Company’s $2,000 excise return is due July 15 but they don’t fund their EFT until July 16, file on July 20, and finish payment on July 18, they’ll face FTD penalties for that one‑day late deposit, FTP penalties for three days of unpaid tax, and FTF penalties for five days of late filing plus interest on every late dollar. Those charges can quickly balloon into the hundreds or thousands, so treat every deadline, filing, depositing, and paying as equally nonnegotiable. Even if you can’t meet all three, at least get the money in on time, then catch up on the paperwork.

At the end of the day, TTB compliance is really just about two things: knowing where every barrel went and having the right paperwork to prove it. Nail those basics, cover your bond, nail your EFT payments, keep your daily logs neat, and have the right permits and you’ll dodge most audit headaches.

Put those quick tips to work. Set a few calendar reminders, give your records a once‑over every month, keep one sheet or dashboard for your COLAs and formulas, and check your bond and permits whenever you add a new brew or hit a production milestone. Do that, and you’ll spend less time scrambling.

Remember, compliance isn’t a checkbox you tick once. It’s a habit. Treat every little audit trigger as a chance to tighten things up, and you’ll not just survive your next TTB visit you’ll come out stronger. Here’s to stress‑free audits and even better brews!